Foreign Funds of Rp23.67 Trillion Leave the Government Securities Market, Bank Indonesia Becomes the Backer

JAKARTA – Total foreign investor funds in rupiah-denominated government securities throughout the current year have already disbursed Rp23.67 trillion, in line with the increasing yield of US Treasury. Government securities (SBN) in this paper include debt securities (SUN) and government shariah securities (SBSN/sukuk). The departure of foreign investors’ funds began in February 2021, which for […]

Fadel Surur

Author

Ilustrasi penanaman modal asing di Indonesia turun akibat wabah virus corona. / Pixabay

(Istimewa)JAKARTA – Total foreign investor funds in rupiah-denominated government securities throughout the current year have already disbursed Rp23.67 trillion, in line with the increasing yield of US Treasury.

Government securities (SBN) in this paper include debt securities (SUN) and government shariah securities (SBSN/sukuk).

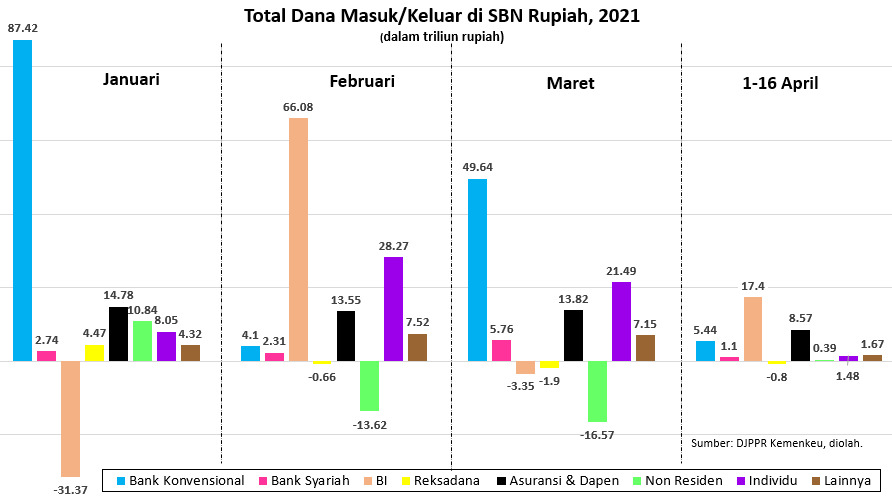

The departure of foreign investors’ funds began in February 2021, which for a month reached Rp13.62 trillion. Then, in March 2021 foreign investor funds seeped again with Rp16.57 trillion worth. From the beginning of February to the end of March 2021, the total outflows of foreign funds from government securities reached Rp33.61 trillion.

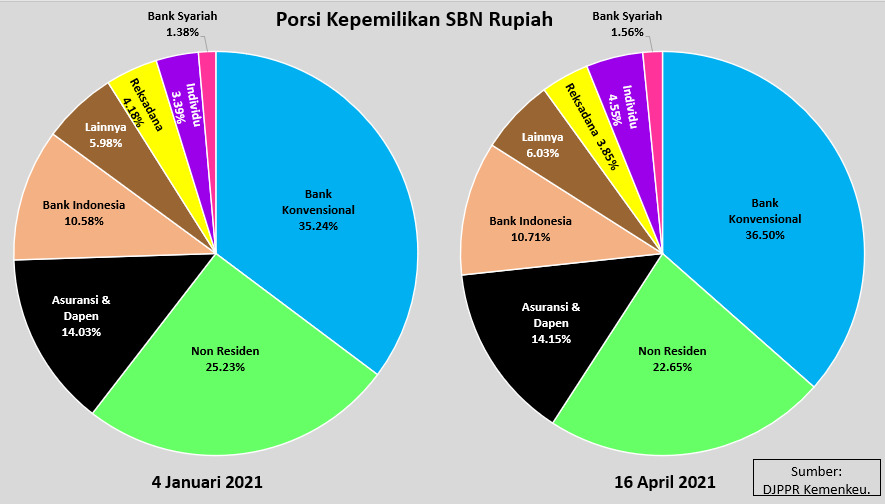

Thus, the share of foreign ownership in SBN continued to shrink. As of January 29, the foreign share was 24.86%, then on February 26 it fell to 23.81%, and frowned to 22.89% as of March 31.

Total net monthly funds in/outflow of investors in the government securities rupiah Market.

Source: DJPPR, processed.

While foreign investor funds slip away, the yield on the 10-year US Treasury increases.

Based on data from World Government Bonds, the increasing trend in the US Treasury yields occurred since early February when it was at 1.079% until it landed at the level of 1.744% as of March 31. US Treasury yields have risen 66.5 bps within 2 months.

On Tuesday, March 30, 2021, the yield on the 10-year US bond rose to its highest level in 14 months, i.e 1.77%. Quoted from Reuters, the surge in the US Treasury yields was triggered by the plan of the US President, Joe Biden, to disburse US$2 trillion worth of infrastructure funds for the Build Back Better program.

The strengthening of the US Treasury was followed by an increase in the yield on Indonesian 10-year bonds. Indonesia’s yield increased by 61.5 bps during the beginning of February to March 31, 2021 at the level of 6.886%.

Pilarmas Investindo Sekuritas estimates that the yield on the 10-year US Treasury will still have the potential to rise to the range of 1.8% to 2%. If the US yield reaches 2%, it is possible for the stock market to experience correction and push the rupiah down.

BI Strengthens Government Securities Market

When foreign investors’ funds worth Rp13.62 trillion left government securities rupiah last February, Bank Indonesia (BI) bought up Rp66.08 trillion worth of government securities. BI can indeed buy government securities at an auction held by the Ministry of Finance, including participating in the green shoe option. This action can certainly energize the government securities rupiah market.

When Rp16.57 trillion in foreign investor funds left the government securities in March 2021, conventional banks purchased government securities worth a total of Rp49.64 trillion. Conventional banks also put their funds into government securities worth Rp87.42 trillion in January 2021.

Apart from banks and BI, individuals also strengthened the government securities rupiah market. In February and March individuals brought in funds totaling Rp49.76 trillion into government securities.

Insurance and pension funds also regularly buy government securities. During January to March 2021, insurance and pension funds bought an average of Rp14 trillion worth of government securities monthly.

Source: DJPPR, processed.

In terms of the proportion of SBN ownership in early January and April 16, 2021, conventional banks are still dominant in holding government securities rupiah with a portion in the range of 35% to 36%. Followed by foreign investors who still hold a share above 20%. Individual ownership in government securities rupiah is expanding, from 3.39% in early January to 4.55% on April 16.

Improving from Last Year?

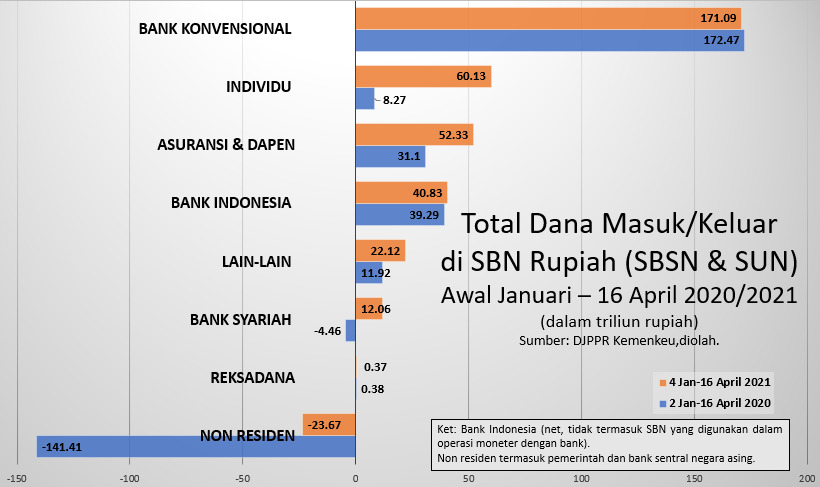

The outflow of foreign investors from government securities this year is much smaller, compared to the 2020 data in the same period of early January to April 16.

The amount of in/outflow funds of investors in early January-16 April 2020/2021.

Source: DJPPR, processed

Since the beginning of January to April 16, 2020, foreign investors took their funds out of government securities worth Rp141.41 trillion. The biggest drop of foreign funds from the government securities occurred in March 2020, i.e Rp112.74 trillion. The share of foreigners in government securities also shrank from 36.79% in early March to 32.71% at the end of March.

This action shows how worried foreign investors are about the investment conditions hit by the COVID-19 pandemic.

It is Bank Indonesia that powers the government securities rupiah market. BI recorded a total of Rp137.98 trillion in funds during March last year. Conventional banks also support the government securities market, with the share of government securities ownership maintained at around 25%.

Writer: GND