Corporate Bonds Reel in, Financial Companies Lead Jumbo Emissions

Throughout 2021, when the Indonesian economy was still hit by the effects of the COVID-19 pandemic, a number of corporations continued to intensify their strategy of seeking finance through the issuance of bonds. The activity of bond issuance in the first five months of this year feels stronger than last year. From the recapitulation of […]

Fadel Surur

Author

Ilustrasi uang rupiah di bank / Shutterstock

(Istimewa)Throughout 2021, when the Indonesian economy was still hit by the effects of the COVID-19 pandemic, a number of corporations continued to intensify their strategy of seeking finance through the issuance of bonds. The activity of bond issuance in the first five months of this year feels stronger than last year.

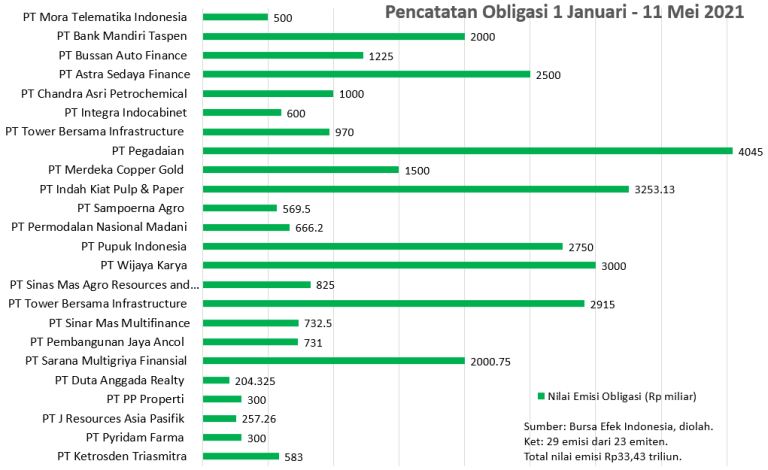

From the recapitulation of the Indonesia Stock Exchange data, the total bond issuance (including sukuk) that has been recorded since early January to May 11, 2021 reached Rp33.43 trillion. This total emission was 52.02% higher than the total emission in the same period last year (1 January to 11 May 2020).

A total of 29 emissions of 23 have been listed on stock exchange trading board throughout the current year. Most bond issuers come from the financial sector.

This sector is also the largest contributor to total emissions. Its contribution reached Rp13.2 trillion or approximately 39.5% of total emissions. PT Pegadaian, which also comes from the financial sector, is in the top position of the issuer with the highest emission value of Rp4.045 trillion.

Issuers from the infrastructure sector also enlivened the listing of bonds throughout the year. There are four infrastructure companies that have listed bonds with total emissions reaching Rp7.97 trillion or 23% of the total emissions.

Following Pegadaian that issued jumbo emissions, PT Tower Bersama Infrastructure Tbk. (TBIG) issued large emissions of Rp3.885 trillion. Two bonds were issued during the first 5 months of this year.

In terms of issuance value, as many as 11 out of 23 issuers issued bonds above Rp1 trillion. Only five issuers issued bonds of Rp500 billion or below.

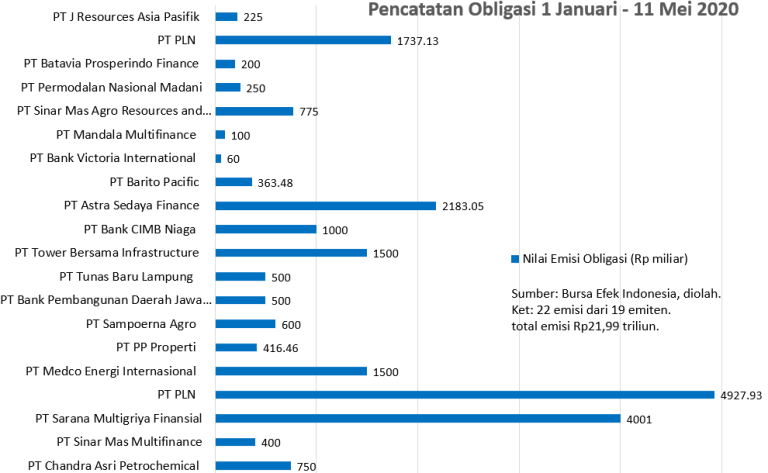

Meanwhile, the total value of bond issuance from early January to 11 May 2020 was only Rp21.99 trillion. The total value comes from 22 issuance issued by 19 issuers.

PT Perusahaan Listrik Negara (Persero) became the largest bond issuer, namely Rp4.93 trillion or 22.4% of the total issuance. The next largest bond issuer is a financial State Owned Enterprises, PT Sarana Multigriya Finansial. Its emission value reaches Rp4 trillion or 18.2% of the total emissions.

Judging by the size of the issuance, only seven out of 19 issuers ‘dared’ to issue bonds with a value of Rp1 trillion or above. Most, to be exact, 10 issuers, issued bonds with a value of Rp500 billion or below.

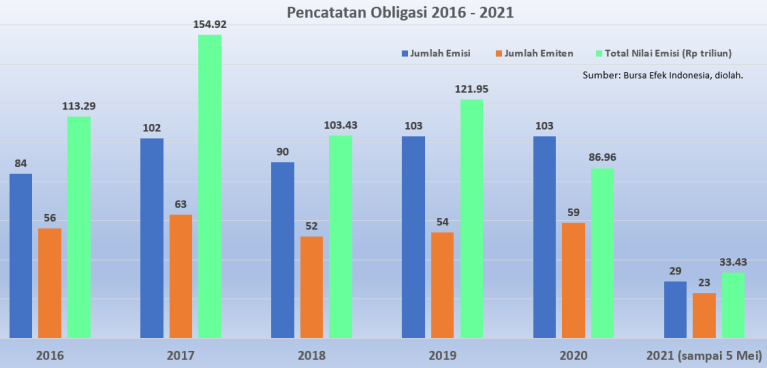

Over the past five years, 2020 has been the year with the smallest bond issuance value. The total bond issuance listed on the IDX in 2020 was only Rp86.96 trillion, a 28.7% decline from the total issuance of the previous year. The COVID-19 pandemic was the main factor in the small total emission value at that time.

From 2016 to 2019, the total annual issuance could reach more than Rp100 trillion, but not in 2020. The value of issuance in 2020 was recorded to be smaller than in previous years, although the number of issuance and the number of issuers that issued bonds were not much different from those of the past years.

In fact, in 2020 the number of issuance is the same as in 2019 and the number of issuers is more than 2019. This indicates that issuers that are bound to the continuous public offering stage will issue bonds of small value. This indication can also be read as a response to the low corporate bond market amid the COVID-19 pandemic.

Writer: Gloria Natalia Dolorosa

Article in Bahasa Indonesia: Obligasi Korporasi Bergeliat Kembali, Perusahaan Keuangan Pimpin Emisi Jumbo